Why You Need a Certified Loan Signing Agent for Your Real Estate Closing

A certified loan signing agent is a specially trained notary public who oversees the signing of loan documents for real estate transactions, ensuring all paperwork is executed correctly, legally, and promptly returned to your lender or title company.

Key Things to Know About Certified Loan Signing Agents:

- Specialized Training: They undergo additional certification beyond standard notary requirements to handle complex mortgage documents

- Error Prevention: They’re trained to catch common mistakes that could delay your closing

- Background Screened: Most carry Errors & Omissions (E&O) insurance and pass rigorous background checks

- Mobile Service: Many offer convenient appointments at your home or office

- Typical Fee: $75-$200 per signing, reflecting their specialized expertise and the complexity of loan packages

If you’re buying a home, refinancing your mortgage, or completing any real estate transaction, you need someone who understands the specific requirements of loan documents. A regular notary public can notarize your signature, but they aren’t trained to handle the 100+ page loan packages that require signatures, initials, and dates in dozens of precise locations.

Why does this matter to you? Errors in loan documents can delay your closing by days or even weeks. They can cost you money in extended rate locks or lost earnest money. A certified loan signing agent acts as your safeguard—an impartial witness who ensures every signature line is completed correctly and every document is properly notarized according to your lender’s requirements.

As a notary and wedding officiant in Jacksonville, we’ve guided countless clients through the loan signing process, ensuring their documents are handled with the professionalism and accuracy that such an important financial transaction deserves. At Rainbow Notary And Nuptials, we specialize as a certified loan signing agent team, bringing mobile convenience and peace of mind to your closing experience.

Ready to schedule your loan signing? Book your appointment online for fast, professional service across Jacksonville and all of Florida.

What Makes a Certified Loan Signing Agent an Expert?

When you’re closing on a home or refinancing your mortgage, you need more than just any notary—you need a certified loan signing agent. Think of us as the specialists of the notary world, trained specifically to handle the unique complexities of real estate transactions.

A general notary public plays an important role in everyday document verification. They can notarize your power of attorney, witness signatures on affidavits, or certify copies of important documents. But when it comes to your mortgage closing, you’re dealing with a completely different level of complexity. A typical loan package contains 100 or more pages, with dozens of places requiring your signature, initials, or dates. One small mistake—a missed signature, an incorrect date, or a skipped initial—can delay your closing by days or even weeks.

That’s where a certified loan signing agent makes all the difference. We undergo specialized training that goes far beyond basic notary education. We study real estate finance, learn the purpose and function of every document in your loan package, and master the precise procedures that lenders and title companies require. We know the difference between a deed of trust and a closing disclosure. We understand which documents need to be notarized and which simply need your signature. And we’re trained to catch common errors before they become problems.

Here’s how our expertise differs from a general notary:

| Feature | General Notary Public | Certified Loan Signing Agent |

|---|---|---|

| Scope of Work | Certifies signatures, administers oaths | Facilitates entire loan closing, guides you through all documents |

| Documents Handled | Affidavits, deeds, powers of attorney | Complete mortgage packages: deeds of trust, closing disclosures, promissory notes |

| Training | Basic state-mandated notary course | Extensive specialized training in loan documents and real estate finance |

| Certification | State notary commission | State notary commission plus additional industry certification |

| Background Checks | Varies by state | Rigorous annual background screening |

| E&O Insurance | Often lower limits | Higher coverage (typically $25,000+) to protect your transaction |

| Knowledge Required | State notary laws | State notary laws plus real estate finance, closing procedures, lender requirements |

| Compensation | State-set fees per notarization | $75-$200 per signing, reflecting specialized expertise |

More info about our specialized loan signing services

The Key Differences in Service and Expertise

The biggest difference between a general notary and a certified loan signing agent is the scope of what we do for you. A general notary verifies your identity and watches you sign. That’s it. Their job ends when your signature hits the paper.

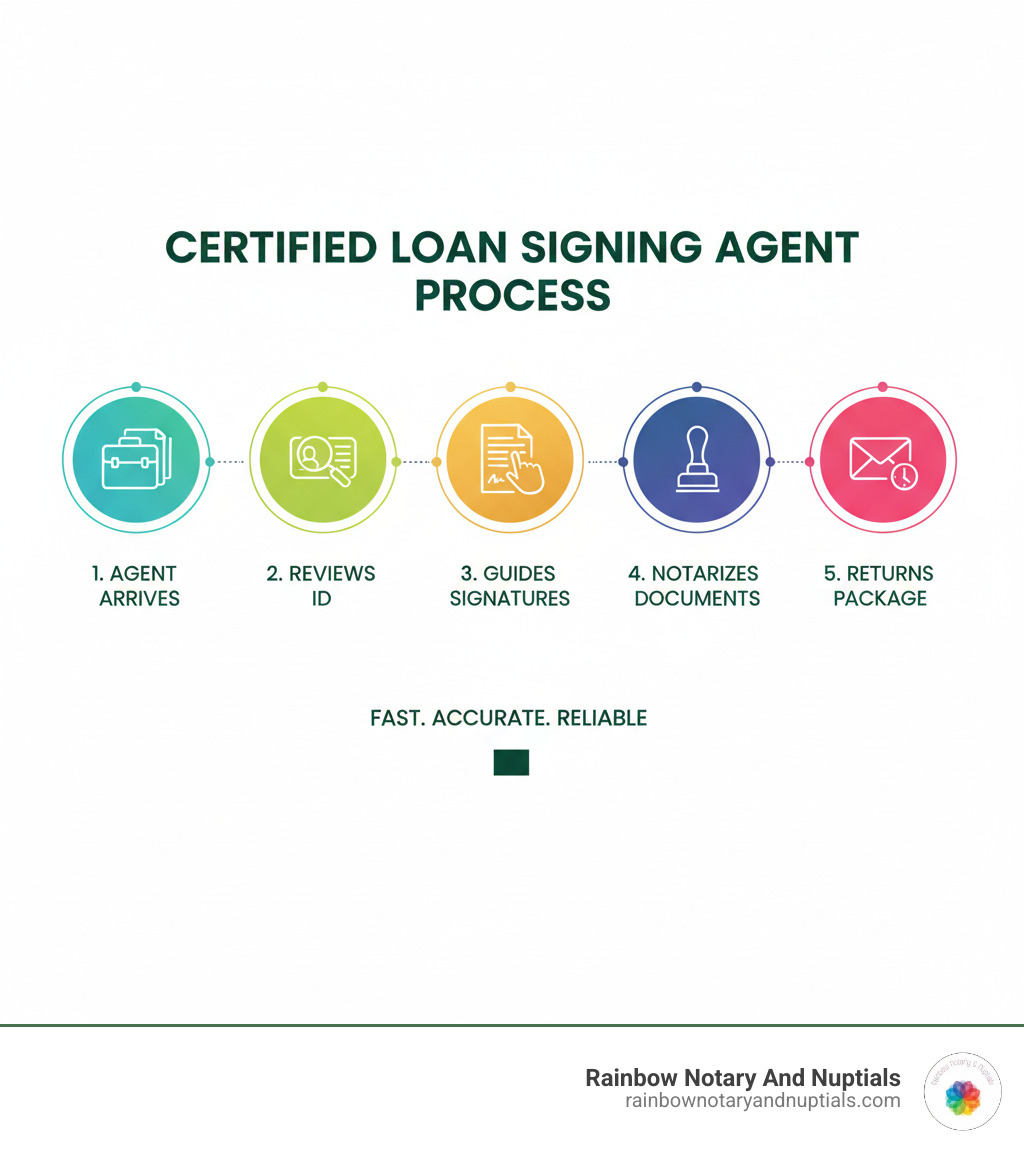

A certified loan signing agent guides you through your entire closing appointment. We arrive with your complete loan package, already familiar with your lender’s specific instructions. We walk you through each document, identifying what you’re signing and where you need to place your signature, initials, or dates. We ensure every notarized document includes the proper certificate wording and official seal. And when we’re done, we promptly return your documents to your lender or title company, keeping your closing on schedule.

Our certification requires in-depth knowledge of real estate finance and closing procedures. We understand how a mortgage works, what each document accomplishes, and why certain signatures must be notarized while others don’t. This expertise allows us to move efficiently through your signing appointment while maintaining absolute accuracy. The typical fee of $75 to $200 per signing reflects both the specialized training we’ve completed and the significant responsibility we carry in handling your important transaction.

Why a Standard Notary Public Isn’t Enough for Loan Closings

A standard notary public simply isn’t trained to handle a loan closing. While they’re perfectly qualified to notarize a single document or witness a signature, they lack the specialized knowledge required for mortgage transactions. More importantly, they’re legally prohibited from explaining what your documents mean or offering any guidance about the loan terms—and they shouldn’t try.

When you’re sitting at your kitchen table with a stack of closing documents, you need someone who can confidently identify each form and guide you through the process. You need to know which documents require notarization, where to sign versus initial, and how to date each form correctly. A general notary can’t provide that level of guidance.

The risk of errors is real and costly. A missed signature on page 47 of your loan package means your documents get returned to you for correction, delaying your closing. An incorrectly completed form might require the entire document to be reprinted and re-signed. Your lender and title company have specific requirements that must be followed precisely, and they count on a certified loan signing agent to ensure everything is done right the first time.

That’s why we exist. We’re trained to execute your closing flawlessly, ensuring every signature is in place, every date is correct, and every notarization meets legal requirements. We protect your closing from delays and keep your home purchase or refinance moving forward smoothly.

Ready for a stress-free closing experience? Our certified loan signing agents serve Jacksonville and all of Florida with professional, mobile service. Book your appointment today to schedule your loan signing.

The Critical Role of a Certified Loan Signing Agent in Your Transaction

Picture this: you’ve finally reached the finish line of your home buying or refinancing journey. You’ve found the perfect property, secured your loan, and now you’re sitting down to sign what feels like a mountain of paperwork. This is the moment when a certified loan signing agent becomes your trusted guide through the closing process.

We’re not just witnessing signatures—we’re your safeguard against errors that could delay your closing or, worse, expose you to fraud. Think of us as the quality control specialists who make sure every “i” is dotted and every “t” is crossed in your loan documents. Our specialized training means we understand exactly what lenders and title companies need, and we coordinate seamlessly with them to ensure your transaction closes on time.

Here’s the thing: accuracy matters tremendously in real estate transactions. A single missed signature or incorrectly dated form can send your entire closing back to square one. That’s why having a professional who knows these documents inside and out isn’t just helpful—it’s essential for your peace of mind.

More info about the benefits of professional notary services

Core Responsibilities for a Smooth Signing

When you work with a certified loan signing agent from Rainbow Notary And Nuptials, you’re getting someone who takes care of every detail of your loan closing appointment. We start by guiding you through each document, explaining which form you’re looking at (though we can’t interpret what it means legally) and showing you exactly where to sign, initial, and date. With loan packages often exceeding 100 pages, this guidance is invaluable.

We’re experts at identifying the specific documents in your package—from the Promissory Note to the Deed of Trust to the Closing Disclosure. Each document serves a specific purpose, and we make sure they’re all handled correctly. As we work through your signing, we carefully obtain every required signature and initial. Missing even one can cause frustrating delays, so we double-check as we go.

Verifying your identity is another fundamental responsibility. We carefully examine your government-issued ID to confirm you are who you say you are—this protects everyone involved from potential fraud. Finally, we ensure prompt return of your documents to the title company or lender. Time-sensitive deadlines are common in real estate, and we make sure your completed package arrives exactly when and where it needs to be.

Ready to schedule your loan signing? Book your appointment online today!

How a Certified Loan Signing Agent Ensures Accuracy and Prevents Errors

Your loan closing represents one of the biggest financial transactions of your life, so getting it right the first time isn’t optional—it’s mandatory. That’s why we conduct a meticulous review of your loan package both before your appointment and during the signing itself. We’re trained to spot potential issues before they become problems.

Our experience means we’re familiar with the common mistakes that can derail a closing. We’ve studied what goes wrong and how to prevent it, so you don’t have to worry. Every lender and title company has their own specific requirements for how documents should be signed, dated, and returned. We follow these instructions precisely, ensuring your package meets every requirement the first time through.

This attention to detail means you can focus on the excitement of your new home or the benefits of your refinance, while we handle the technical precision of the paperwork. That’s the Rainbow Notary And Nuptials difference—professional service delivered with a personal touch.

The Importance of Certification and Background Checks for Your Security

Your financial future is a big deal, right? Especially when you’re signing stacks of important loan documents for your home. You want to feel completely safe and secure. That’s exactly why the extra steps our certified loan signing agents take, like special training and thorough background checks, are so incredibly vital. It’s all about building your trust, keeping your information private, and making sure your money matters are handled with the utmost care. We stick to the highest professional standards to keep your private information safe and ensure your whole transaction is solid.

What “Certified” Really Means for You

When we say a certified loan signing agent is “certified,” it’s not just a fancy badge; it’s a promise to you. It means we’ve gone the extra mile to prove our expertise and commitment. First, we’ve passed comprehensive exams that really test our knowledge of all those loan documents, proper signing steps, and doing things the right way, legally and ethically. Trust us, it’s not easy! But it means we truly understand the ins and outs.

Plus, real estate and lending changes fast, so our certification means we’re always diving into ongoing education and professional development. This keeps us super current with new rules and best practices, making sure we’re always at the top of our game for you. And finally, being certified means we live by a strict code of conduct. This code makes sure we’re always fair, honest, and pay super close attention to every single detail. It’s our way of protecting you and making sure your important transaction is handled perfectly.

The Role of Background Checks and E&O Insurance

Your privacy is a huge deal to us, and your security is our top priority! That’s why every certified loan signing agent at Rainbow Notary And Nuptials goes through rigorous background checks, usually every single year. These checks make sure you’re working with someone trustworthy and with a spotless record, especially since we’re handling your most sensitive financial and personal information during your loan closing. It gives you, your lender, and the title company that extra peace of mind you deserve.

And just to be extra careful (because even the best can make a tiny human error!), we also carry Errors & Omissions (E&O) insurance. This isn’t just some optional extra; it’s a super important safeguard for everyone involved. E&O insurance protects all parties in the very rare case of an accidental mistake during the signing. It shows how professional we are and how seriously we commit to keeping your financial assets safe, no matter what. We truly believe in being prepared for everything!

The Loan Signing Process: What to Expect at Your Appointment

You’ve made it to the final stage of your real estate journey – the loan signing! This might sound daunting, but one of the biggest perks of choosing a certified loan signing agent from Rainbow Notary And Nuptials is how easy we make it for you. We believe your closing should be a celebration, not a chore. That’s why we bring our services right to you!

Whether it’s the comfort of your kitchen table, your busy office, or even a local coffee shop, we’ll meet you at your preferred location in Jacksonville or anywhere across Florida. We arrive with your complete loan document package, ready to guide you through each step. We’ll verify your identification, carefully walk you through every document needing a signature or initial, and make sure all notarizations are performed perfectly. Most appointments with a trained certified loan signing agent take about an hour, though complex loans might take a bit longer. Our goal is always to make this exciting final step as smooth and efficient as possible!

Discover the convenience of mobile notary services

How to Prepare for Your Loan Signing

To help your loan signing appointment sail smoothly and quickly, a little preparation goes a long way. First, it’s always a good idea to confirm your appointment details with us – the date, time, and location. If anything changes on your end, please let us know right away!

Next, and this is super important, please prepare your valid identification. You’ll need an unexpired, government-issued photo ID (like a driver’s license, state ID, or passport). For everyone’s security, we’re legally required to verify your identity. If there are multiple people signing, each person will need their own valid ID ready. We also suggest you ask any questions about loan terms or financial implications beforehand directly to your lender or title company. While your certified loan signing agent can identify documents and guide you on where to sign, we can’t offer legal or financial advice.

Finally, it’s wise to set aside adequate time for the signing. While many appointments are completed in about an hour, having a little extra buffer ensures a relaxed environment, helping to prevent any rushing or potential errors.

The Convenience of a Mobile Certified Loan Signing Agent

In our world, convenience is key, and our mobile certified loan signing agent services are designed with your busy life in mind. We offer truly flexible scheduling, working around your availability – whether you prefer early mornings, evenings, or even weekends.

The best part? We meet at your location. Imagine signing those important mortgage documents from the comfort of your own home, your office, or wherever suits you best. This means you don’t have to worry about traffic, finding parking, or rearranging your entire day. This personalized service significantly reduces stress, allowing you to focus on the excitement of your closing without any added logistical problems.

Ready to experience a smooth, convenient loan signing? Book your mobile notary appointment in Jacksonville today!

Frequently Asked Questions about Using a Loan Signing Agent

It’s totally normal to have questions when you’re looking for a certified loan signing agent! We get it, real estate closings can seem a little complicated. So, let’s clear things up with answers to some of the most common questions we hear.

Can a loan signing agent explain the loan terms to me?

This is a fantastic and very important question! While your certified loan signing agent is a crucial part of your loan closing, their role is specific and impartial. Think of us as your expert guide through the paperwork jungle, making sure everything is signed correctly.

We can clearly identify each document for you and show you exactly where to sign, initial, or date. However, by law, we are not allowed to explain the meaning of loan terms, offer legal advice, or give financial advice. These are important details that should come directly from your lender, real estate agent, or attorney. We always recommend reviewing your loan documents with them before your signing appointment. Our main goal is to ensure every signature is in the right place, helping you avoid any costly errors or frustrating delays.

How long does a typical loan signing appointment take?

We know your time is precious! A typical loan signing appointment with one of our well-trained certified loan signing agents usually breezes by in about an hour. We’re efficient and organized to get you through the paperwork smoothly.

However, sometimes things can take a little longer. For example, if your loan package is extra complex with many disclosures, or if there are several people signing, it might extend beyond an hour. Also, if you’ve got questions for your lender (which, again, we encourage you to ask before our meeting!), the signing might take a bit more time. To make sure you feel relaxed and unhurried, we always suggest setting aside a bit of extra time.

Why does a certified loan signing agent cost more than a regular notary visit?

That’s a fair question, and it’s true that the fee for a certified loan signing agent is typically higher than for a quick, single-document notarization. But there are some really great reasons why this investment is so worthwhile for your peace of mind!

The fee reflects the significant value and specialized service you receive. First, our certified loan signing agents undergo specialized training specifically for loan documents. This goes far beyond what a general notary learns and is crucial for catching potential errors. Second, there’s higher liability involved with loan transactions, which often deal with substantial financial sums. Our Errors & Omissions (E&O) insurance reflects this added responsibility. Third, a loan package isn’t just one or two pages; it can easily be well over 100 pages! We spend considerable time preparing, reviewing, printing, and organizing these extensive documents before we even arrive at your door. And finally, many certified loan signing agents, like us at Rainbow Notary And Nuptials, offer mobile service convenience, bringing the entire closing to your preferred location.

When you consider the complexity, the expertise, the responsibility, and the convenience, the fee for a certified loan signing agent is truly an investment in ensuring your closing is smooth, accurate, and wonderfully stress-free!

Ready to experience a smooth, worry-free closing? Book your mobile notary appointment online today! We’re here to help you get to the finish line with confidence.

Conclusion

So, you’ve worked hard to reach this point – your real estate closing! It can feel like a mountain of paperwork. But don’t worry. With a certified loan signing agent from Rainbow Notary And Nuptials, that mountain becomes a smooth path. We’re here to make sure your closing is clear, confident, and completely stress-free.

We specialize in turning what could be a confusing process into a simple, error-free experience. Our job is to guide you through every single document. We check that all lender requirements are met. Our professionalism and deep expertise are your promise of a successful signing. You get peace of mind, knowing everything is handled perfectly.

At Rainbow Notary And Nuptials, we’re really proud of our service. As certified loan signing agents, we bring the highest standards to Jacksonville and all of Florida. We stand by our commitment to inclusivity, just like our motto, “Marrying Everyone Under the Rainbow.” This means we give every client our full, warm, and professional attention. Your important documents are always handled with the utmost care.

When you need professional and reliable service for your real estate closing, trust a certified expert. Let us bring precision and calm to your next big transaction.

Ready for a smooth closing? Don’t leave your important loan documents to chance! Book your mobile notary appointment in Jacksonville today! We can’t wait to help you!